Introduction

In an ever-evolving regulatory landscape, a USA-based investment group faced the formidable challenge of enhancing its Client Lifecycle Management (CLM) processes. Striving to meet compliance requirements while ensuring a seamless client onboarding experience, they turned to eClerx Compliance Manager, a strategic technological solution. This case study delves into the remarkable journey of this transformation and the key milestones achieved across four phases.

The Challenge

- Efficient and compliant Client Onboarding.

- Streamlined KYC processes.

- Enhanced AML capabilities.

- Robust document enrichment.

- Secure client interactions.

The Solution

eClerx Compliance Manager was chosen as the comprehensive solution to fulfill these requirements.

The overall solution was provided in 4 stages:

1) Rapid Deployment and Client Onboarding

- eClerx Compliance Manager was deployed within six weeks, kick-starting the Client Onboarding platform.

- KYC data was efficiently managed with eClerx Compliance Manager serving as the system of record.

2) Expanding into AML Operations

- The scope expanded to include periodic reviews, solidifying eClerx Compliance Manager’s position within the core AML infrastructure.

3) Integration of Document Digitization

- Upstream expansion into Fund Subscription and Tax form document digitization was facilitated using DocIntel.

4) Introduction of Client Portal

- The project culminated with the digitalization of Client Onboarding and Fund Subscription through a client portal, ensuring a seamless and interactive client experience.

Keywords:

Third party application integration

(Salesforce),

Document enrichment

[DocIntel web services],

Client facing portal

Third party application integration

(Salesforce),

Document enrichment

[DocIntel web services],

Client facing portal

KYC Workflow Evolution

The transformation included the following stages in the KYC workflow:

- Request Initiation

- Self-Sourcing

- Document Review

- Data Gap Analysis

- Investor/Client Outreach

- Screening

- Risk Analysis, QA Approvals, Signof

- Case Data Transfer

Results and Impact

The transformation yielded remarkable results:

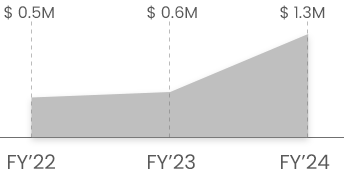

Financial Growth: Total revenue projection grew

from $0.5 million in FY’22 to $0.6 million in FY’23

and to an impressive $1.3 million in FY’24.

Financial Growth: Total revenue projection grew

from $0.5 million in FY’22 to $0.6 million in FY’23

and to an impressive $1.3 million in FY’24.

Future Outlook

As the industry continues to face new challenges and regulatory changes, the organization is poised to stay ahead with eClerx Compliance Manager, shaping a future where compliance is seamless, efficient, and customer-centric.

Conclusion

The successful implementation of eClerx Compliance Manager not only enhanced compliance and KYC processes but also unlocked substantial revenue growth for the investment group. With a forward-looking approach, they are well-prepared to navigate the evolving landscape of Client Lifecycle Management and Anti-Money Laundering.