With Billing Manager, you get

-

Rapid turn around

Accrual data ready by end of month, leading to invoice dispatch for receivables by BD 5 and faster turnaround for payable. 87% of brokerage payables (manual) and 92% of brokerage receivables (manual) closed within 30 days.

-

Duplicate Payment Avoidance

Trade level reconciliation enables easy identification of duplicated trades (already paid via electronic platform), as well as trade level fund application, allowing for robust balance sheet substantiation and avoidance of duplicate payment.

-

Multi Level reporting

Pre-defined reports providing incisive management information as well as the ability to drill into detail across numerous dimensions.

SOLUTIONS

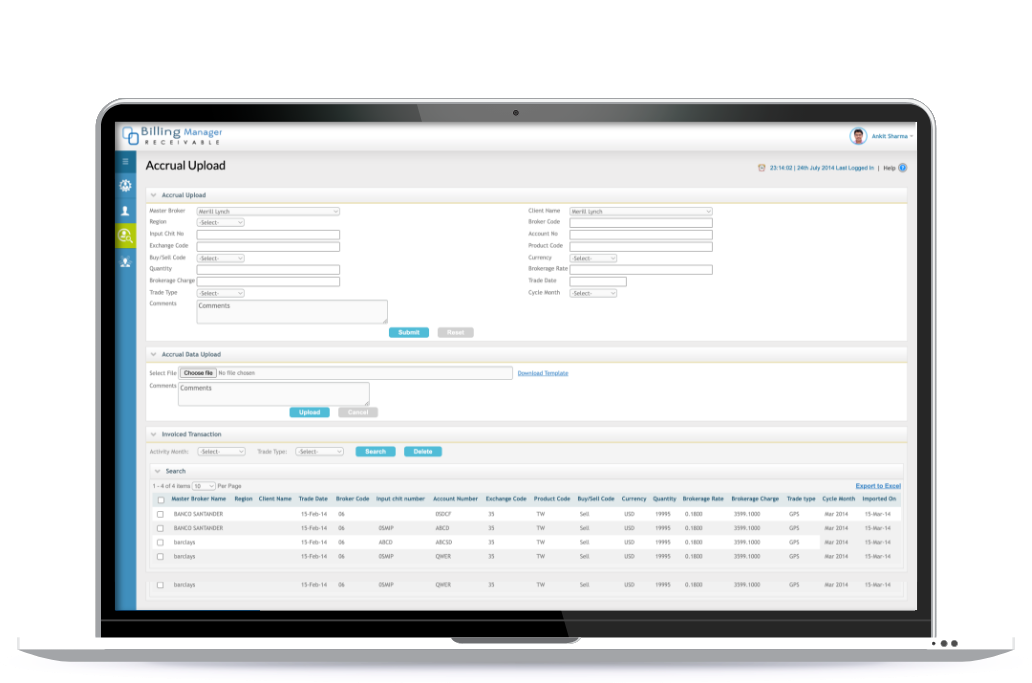

End-to-end invoice processing, logging & reconciliation with discrepancy resolution and payment validation.

Client system matching for incorrect accrual identification, allocation of variation fee and existing fee restructuring on corresponding exchange systems.

From legacy back-office solutions (GMI,R&N) and electronic brokerage platforms (eGains,GPS).

End-to-End receivables management, accounting and discrepancy resolution with rate schedule creation and trade pricing for eTrades.

Reconcile brokerage amount with feeds from electronic platform and allocate the variation in fee to underlying accounts.